Structured Data (SEC, Europe)

Our Company provides

Cloud Financial Datasets & Reports

Both the US SEC and European regulatory authorities are increasingly requiring digital data to be provided in a structured format, like XBRL, with each piece of data being tagged/barcoded to enable simpler comparisons between sets of data. This includes Climate change and Environmental, Social, and Governance (ESG) information. The advantages to all include:

- Enhanced data transparency.

- Improved granularity of data.

- Delivering true value to comprehensive accurate datasets for easy comparison.

- Improves how users perform their work as they have more time to analyze data.

- Provides significant time and efficiency savings. Consumers of financial data reduce the time spent on inefficient and costly manual processes, including locating, assembling, and reentering data, and concentrate their efforts on analysis and new business development.

- Provides immediate, or near immediate, access to complete datasets.

- Data is traceable back to the source documents from entities.

- Easing the compliance and audit requirements of investors and others users of financial information.

- Super-charges the capacity of investors, as well as their analytical horsepower, including using machine learning and Artificial Intelligence (AI) to work with the tagged data.

- Customers being able to choose suppliers based on their appetite for information, perception of quality of service, cost and efficiency of service.

- Comparing past trends of company data before current submissions are made to ensure the filing look reasonable.

- Enhancing the usefulness of SEC data.

- Improved tax policy and considerations with more accurate market information and understanding.

- Improve comparative industry peer performance analysis.

- Improves the quality of submitted data by enabling preparers being able to compare and learn from their own peers. This enables preparers to standardize and improve disclosures.

- Improved trust in the financial markets.

- Improved identification of outliers.

- Verification simplification of financial assets, e.g. Goodwill.

- More effective corporate disclosure research.

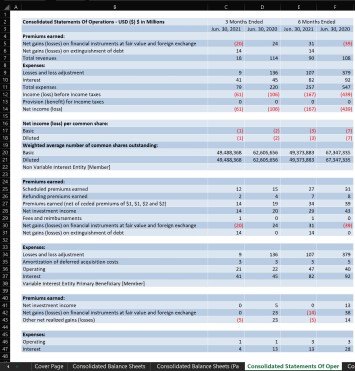

Get 10-K (Annual), 10-Q (Quarterly), 8-K (Current) reports, notes, disclosures and more.

Years in BI Industry

0

+

Years Designing BI Finance

0

+

Satisfied Customers

0

+

Cubes & Datasets Designed

0

+