Chief Financial Officer (CFO)

+1.919.213.1110

Reports for any SEC company, industry companies, or any consolidation/aggregation of any companies.

Responsibilities Include:

- executing the company’s financial strategy,

- the accurate internal/external financial reporting, GAAP compliance, and correct disclosure tagging,

- assisting the CEO in developing growth budgets and forecasts to increase profitability and shareholder value,

- identifying investment opportunities (Acquisitions, Mergers, ESG), and raising of capital to grow the business,

- industry reports reflecting market shares,

- identifying efficiency opportunities from understanding competitor industry public disclosures,

- understanding how the company is being forecast by external parties, and

- establishing and maintaining financial relationships, controlling the cash flow position, shareholder annual and interim reports, etc.

Solutions that help with these responsibilities could be invaluable. Our solutions offer this opportunity.

CFO Dashboards

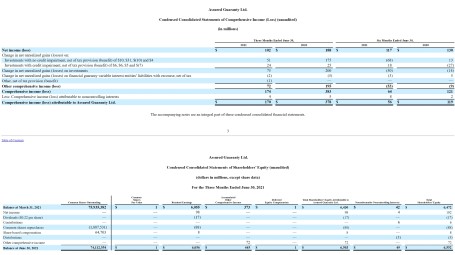

The CFO dashboard and reports (geographical, department and product sensitive) may include:

- Income and Profitability Management,

- Operating Expense Management,

- Financial Planning & Analysis,

- Risk & Compliance Management,

- Investment Opportunities (Acquisition, Merger, ESG)

- Industry Performance, Forecasting, Market Share Information

Company & Industry Forecasts

Of interest is how the company is perceived by investors and competitors and how the company is being forecasted. Our solution forecasts company data, all industry companies, the industry, or any combination of companies. These forecasts are updated automatically. Additional artificial intelligence (AI) and predictive analysis on every line item of data is evolving.

Company & Industry Market Shares

Understanding the size and market share of all the companies in the industry is of interest to management, investors and competitors. Our solution does this, or for any combination of companies, and for any line items, including Revenue, Net profits(Loss), Assets, etc.

Disclosure Line Tagging

Being able to compare the company line disclosure tagging to other industry companies enables identifying tagging errors, and also differences in lines of business. Accurate financial tagging ensures

- numbers are included in company and industry comparatives,

- investors have accurate and complete data for investment decisions,

- identification of potential competitive industry business opportunities,

- the identification of additional useful disclosure considerations beneficial to potential investors, e.g., ESG,

- the company’s reputation remains in tact, and

- more accurate industry numbers result.

Growth, Mergers & Acquisitions

Growth through acquisition or a merger may be considered. The aggregation/consolidation of companies can be completed within minutes, inclusive of forecasting of combined financial statements and any line items such as Revenue, Net Profit (Loss), Total Assets, etc.

Environment, Social & Governance (ESG) Dashboards

Understanding a companies environmental, social and governance (ESG) sentiment, comparative competitor ESG metrics and ESG investment portfolio profile may impact the decisions of investors and employees. It’s become important to be able to compare a company’s financials with it’s competitors in terms of “Talk vs Walk” ESG scores, i.e. the implementation of ESG initiatives as perceived by the market, competitors, and employees versus the claims by the the company regarding ESG initiatives can be key to investors and potential employees. There are various ESG initiative companies to consider, e.g. Sustainability Accounting Standards Board – SASB created the Sustainable Industry Classification System® (SICS®) to solve that problem.

Reports

The reports (pages) cover any SEC company, industry or combination of companies. There is auditability and traceability back to source documents.

Embed Reports

Turbo charge your corporate analysis and competitiveness by subscribing to our Microsoft cloud based reports and datasets. Any SEC company, combination of SEC companies, or SEC industry reports can immediately be embed into your

- website or portal,

- secure SharePoint pages

Leverage Datasets & Models

Optimized Microsoft cloud datasets and models support the required reporting functionality for SEC financial reporting requirements, the volume of submissions and enhanced functionality. Datasets can be integrated, together with over 150 other data sources, across workspaces and with internal data. Over 13,000 companies covered.

Auditability, Traceability & Excel Downloads

Trace and audit all numbers back to the source submission filing documents with easy to use navigation.

Slice, Dice, Filter & Model

Solutions and reports leverage Microsoft’s popular toolsets to slice, dice, filter and model data. These include:

- Power BI

- Excel

- PivotTables

- Excel Free-Form Reporting

Microsoft Teams

Working together is easier with Microsoft Teams. Teams caters for hybrid work and your team can stay informed, organized, and connected discussing their financial reports, visualizations and datasets. This helps accelerate your teams understanding.