Chief Executive Officer (CEO)

+1.919.213.1110

Reports for any SEC company, industry companies, or any consolidation/aggregation of any companies.

Investment Considerations

CEO’s, responsible for the long-term success of the company, are concerned about their company’s growth, earnings, stability, risk, controls, returns on investment and investors. So spending money on a solution is to understand how it

- adds value,

- impacts profitability,

- improves the company’s competitive position,

- improves the companies market share revenues and margins, and

- adds to business processes and initiatives.

Global Considerations

Inflation is a major concern for all, but offsetting the inflationary factors with strategic investments in private and public cloud initiatives is a consideration and where the ROI can contribute to more shareholder value. According to the IMF, the global economy recovery has slowed down significantly due to the Ukraine Russian war.

CEO Dashboards

Having a simple, condensed view of critical business metrics and key performance indicators is essential for CEO’s. CEO dashboard and reports that enable effective and efficient company overviews, market share analysis, market competitiveness, material project insights, problem area identification and more, may include:

- market KPI’s,

- company KPI’s,

- department and geographical breakdowns,

- market share comparison, and forecasts,

- industry competitiveness,

- material project initiatives (e.g. ESG), and

- merger and acquisition data, projections and internal ownership detail.

Our solutions cater for the factors above and includes industry-specific report(s) that take 160-hours to prepare quarterly, and many more hours to understand, are available to be embedded and understood, at a cost-effective price point. CEO dashboards leverage these reports.

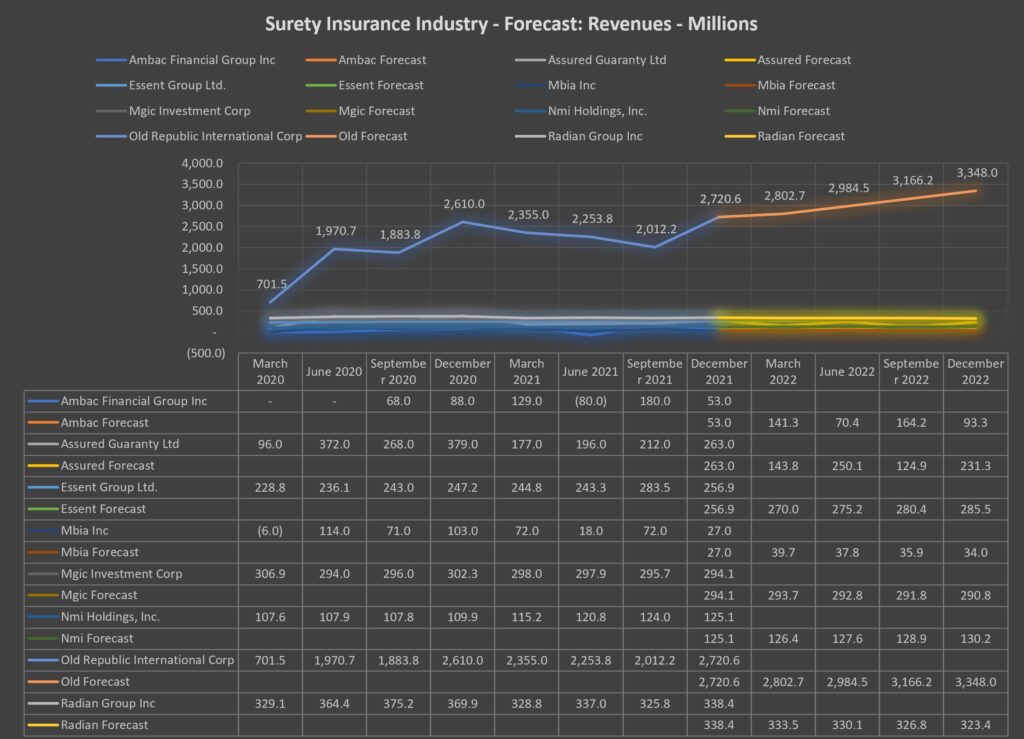

Company & Industry Forecasts

Of interest is how the company is perceived by investors and competitors and how the company is being forecasted. Our solution forecasts company data, all industry companies, the industry, or any combination of companies. Forecast histories and variances could also be evolved. These forecasts are updated automatically. Additional artificial intelligence (AI) and predictive analysis on every line item of data is evolving.

Company & Industry Market Shares

Understanding the size and market share of all the companies in the industry is of interest to management, investors and competitors. Our solution does this, or for any combination of companies, and for any line items, including Revenue, Net profits(Loss), Assets, etc.

Growth, Mergers & Acquisitions

Growth through acquisition or a merger may be considered. The aggregation or consolidation of companies can be viewed within minutes as opposed to weeks, inclusive of forecasting of combined financial statements and any line items such as Revenue, Net Profit (Loss), Total Assets, etc.

Investor Risk

Being able to compare the company line disclosure tagging to other companies in the industry is important to identify tagging errors but also to identifying differences in lines of business. Accurate financial tagging ensures

- numbers are included in company and industry comparatives,

- investors have accurate and complete data to make their investment decisions,

- identification of potential competitive industry business opportunities,

- the identification of additional useful disclosure considerations beneficial to investors, e.g. ESG,

- the company’s reputation remains in tact, and

- more accurate industry numbers result.

Environment, Social & Governance (ESG) Dashboards

Understanding a companies environmental, social and governance (ESG) sentiment, comparative competitor ESG metrics and ESG investment portfolio profile may impact the decisions of investors and employees. It’s become important to be able to compare a company’s financials with it’s competitors in terms of “Talk vs Walk” ESG scores, i.e. the implementation of ESG initiatives as perceived by the market, competitors, and employees versus the claims by the the company regarding ESG initiatives can be key to investors and potential employees. There are various ESG initiative companies to consider, e.g. Sustainability Accounting Standards Board – SASB created the Sustainable Industry Classification System® (SICS®) to solve that problem.

Reports

The reports (pages) cover any SEC company, industry or combination of companies. There is auditability and traceability back to source documents.

Unique Solution Leveraging Microsoft Technology

There are NO other solutions on the market that are at this level of functionality and opportunity as it requires years of accounting and business intelligence experience. We have been in these businesses since 1991. We leverage the Microsoft technologies of Power BI, Excel (PivotTables, Excel Free-Form Reporting) and Teams.